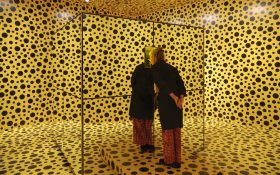

Michael Fox in his Collingwood gallery. Image: Supplied.

Michael Fox is an art appraiser, curator, gallery owner and accountant, who has previously written about the taxation of artwork in Australia. While you may not associate a number-cruncher with someone whose identity is so embedded in the art community, Fox’s unlikely career trajectory brings with it a different, and valuable, viewpoint.

‘I never wanted to be an accountant, I’ve always had a great fascination and love for the arts and that came through my mother,’ Fox said. ‘When I went to university my father said: “You’ll never make money in the arts, Michael, you better do a commerce degree.”’

Fox took his father’s advice but as soon as he left university began working as a freelance writer before opening Fox Galleries in Brisbane, which he now continues to run in Melbourne.

‘It’s not until you are involved with the operations of an art gallery that you understand how it all works,’ he said. ‘To many people, the art market is a great mystery, it just seems to make no sense.’

Working with a range of creative and corporate clients across his accountancy practice, Fox can see the potential for corporates to get more involved in the arts but said many are just dipping their toes in the water.

‘For a lot of people, the choice is that, if they want to be interested in the arts, they’ll contract out that interest by making a charitable donation, but by doing that you don’t really get to understand what’s going on. It’s this sense of: “I’ll go to a black-tie dinner and I’ll give you $300 and I’ve done my part,”’ he explained.

‘If more (business) professionals were involved in the actual running of an art gallery, or at least bought original works of art, it would open up more opportunities for artists, as well an understanding of what they do.’

Visit foxmichael.com.au for more details about Michael Fox’s practice

Working so closely with creatives, and having a solid understanding of the greater arts community has enabled Fox to deeply connect with his clients.

Burlesque performer Kitty Van Horne stumbled across Fox when she was trying to complete her 2016/17 tax return, which wasn’t giving her the high tax refund she usually receives.

‘Michael understands the nuances of arts practice – the inconsistent and varied nature of the work, the sometimes-unusual items performers can and should claim, the long-term patterns of income and loss within artistic sole trader activity, over many years,’ Van Horne said.

Fox adds: ‘People in the arts are small business people. They might not like to think about it that way, but that’s what they are. Like all people in business, tax is a very important consideration for artists; you need to know how much you are paying and you need to make sure you’re not paying too much.’

His other interesting observation through working as an arts accountant stems from the reluctance of corporates to invest in art.

‘With tax policy – what I’ve found interesting is that accountants talk their clients out of investing in the arts all the time,’ he said.

Fox believes this is partly due to the knock-on effect of then Minister for Financial Services and Superannuation Bill Shorten’s 2011 changes to the laws which governed how self-managed super funds could be used to purchase art.

‘That recommendation has had a long-lasting influence on the art market itself. A lot of people said: “Why should I buy art? It’s a terrible investment.” ‘You shouldn’t be thinking about it that way though, because it’s a cultural investment as well,’ Fox said.

‘When you buy art, it is directly assisting the ability of artists to continue their practices. I do not see a problem with providing a tax incentive to allow artworks to be purchased from living Australian artists as long as sensible checks and balances are present’, Fox said.

For more information on Michael Fox please visit: foxmichael.com.au