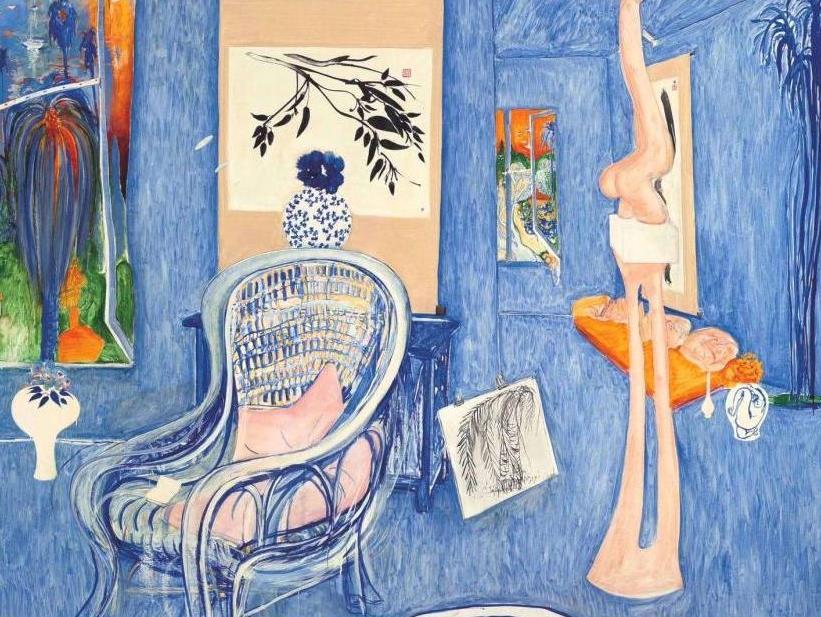

Top painting under the hammer in 2013 was Whiteley’s The Armchair sold by Menzies (detail shown).

15,139 Lots went under the auction hammer in 2013, according to Art Sales Digest, slightly down on the past five years. With a clearance rate of 64%, the lowest since 1997 when confidence in the market equated to just 61%, the average sale value over the last five years has steadily increased to $10,755. In other words, we are selling less but at better prices.

Simply, there was money around in 2013 with auction sales totaling $103.4M. ArtsHub tallied the figures and spoke with six leading houses to get their read on the market this year.

Total Sales by Auction House in 2013: Top 5

1. Bonhams: $31.40M

2. Menzies: $19.25M

3. Deutscher and Hackett: $17.36M

4. Sothebys Australia: $15.22M

5. Lawson-Menzies: $6.90M

Speaking with this year’s market leader, Chairman of Bonhams Mark Fraser told ArtsHub, ‘Bonhams domination of single-owner auctions (such as the Reg Grundy, Colin & Liz Laverty, Sir Sidney Nolan Estate and Clive Evatt auctions this year) and our focus on the top-end of the art market have reflected our perception of a changing market.’

The highest grossing sale for the year – in fact it was Australia’s most valuable single-owner art auction on record – was Bonhams’ June sale of 89 works from the Reg and Joy Grundy Collection. The Sydney sale earned a phenomenal $19.16 million.

Chris Deutscher of Deutscher and Hackett noted the focus: ‘The first half of the year was dominated by single-owner sales – eg Grundy/Laverty.’ He added, ‘For Deutscher and Hackett 2013 was a challenging yet rewarding year with a 25% lift in auction sales. Our final sales for the year, August and November, were relatively strong compared with competitors. It was a year in which we ‘stuck to our knitting.’

So what were the top 10 lots under the hammer in 2013?

1. Brett Whitley, The Armchair (1976), sold at Menzies Art Brands’ South Yarra rooms for $3,927,270 in their October sale.

2. John Glover set a new artist record with the painting Ben Lomond from Mr Talbot’s property four Men catching Opossums $2,984,703, sold at Christies London Australian Sale in late September. Christies reported the painting sold to a London philanthropist, and at more than AU$1 million above the previous auction record for Glover.

3. Fred Williams, You Yangs Landscape 1 (1963), was the first among several lots in the top ten list sold by Bohnhams. With a hammer price of $2,287,500 it lead the Sydney Grundy Collection sale.

4. John Brack, The New House (1953), sold for $1,952,000, the next performer at Bonhams’ Grundy Sale.

5. John Brack, The Breakfast Table (1958), was next in line coming in at $1,464,000, again from the Grundy sale (Bonhams).

6. Fred Williams’ Lysterfield (1968) sold for AU$1.4 million in London at Christies Australian art sale. It well exceeded its estimate.

7. Back at home Fred Williams’ Pool at Agnes Falls (1981) bought Sothebys into the mix. It sold for $1,342,000 at their Important Australian Art sale in Melbourne in early May.

8. Arthur Streeton, Between the Lights, Princess Bridge (1888), took a hammer price of $1,220,000, this time at Bonhams Melbourne auction in August.

9. John Brack, Double Nude 1 (1983), sold in late June at Menzies Art Brand auction in Sydney with a result of $1,178,181.

10. John Brack, The Jockey and his wife (1953) sold above its estimate at $1,159,000, again a win for Bonhams’ Grundy Sale.

Fraser noted, ‘Bonhams sold six out of the top ten lots sold in Australia this year.’ That is an outstanding result and one bolstered by the quality of works offered in the Grundy Sale.

While Christies London sale did make it in this top roll call, only 44 of the 75 lots offered for sale found buyers, resulting in a disappointing overall sale total.

It is not always the big splashes that capture the energy of an auction room. While they may not have achieved the highest hammer result, there were some stand-out sales this year that rocked the art world, rocketing past their estimates.

The Highest Performers in 2013:

1. Top of the list is Bridget Riley’s optical painting Off (1963), a pint sized abstraction offered in Deutscher and Hackett’s August auction, which sold for $984,000, far exceeding its estimate of $60-80,000. As Chris Deutscher said it was, ‘the flyer of the year!’

2. It might have been one of the last auctions of the year, Bonhams November auction, but a suite of seven Ethel Spowers works created a stir with the painting Enchanted Forest (1926) selling for $42,700, blitzing its estimate of $3,500-4,000.

3. Sidney Nolan, an auction perennial, surprised the floor with Bird (1964) offered in the closing lots of Bonhams August sale “Important Early Works from the Estate of Sir Sidney Nolan” for $19,520, well above its modest estimate of $2-3,000.

Top 3 Sales by Aboriginal Artists:

1. Sotheby’s had a stunning result with new record for Lin Onus’s painting Robyn (1995), painted a year before his death and sold for $414,800, well outside its estimate of $160-180,000.

2. Emily Kame Kngwarreye’s painting Alhalkere (1989) was sold by Bonhams for $305,000 in their Sydney Grundy Collection Sale.

3. Lin Onus’ continued to have a strong year across auctions. Deutscher and Hackett sold Fish, Barmah Forest (c1994) for $294,000 in their Melbourne March sale.

Leading the success in terms of clearance was Bonhams’ November sale of Clive Evatt’s Aboriginal Collection with a total sale figure of $929,094 and a clearance of 95% of its huge 320 lots, largely barks.

Bonhams Aboriginal Art Specialist, Francesca Cavazzini, said, ‘We saw around 60 new buyers in the Evatt auction out of the 155 registrants. There was institutional, international and private interest in both art auctions.’

However, across all auctions this year the indigenous art market remained in a slump with a high number of paintings passed in. Have we just reached a glut in this market? Is it a pendulum swing or are the changes to self-managed super funds still cutting deep?

Looking across the board there were several auctions that sat well above the average 64% clearance rate. Menzies October sale of Australian and international fine art and sculpture achieved $8.64M including premiums, which outside of the single-owner collection sales was the most solid result recorded for the year, with 73% by volume and 80% by value.

It was followed by Deutscher and Hackett’s August sale, their most successful for 2013 taking $6.89M. Second to Riley’s graphic masterpiece, top lots were held by Ian Fairweather with Boats at Soochow Creek (1938) selling for $630,000; and Arthur Streeton’s A Road to the Kurrajong (c1896) taking the hammer at $456,000.

Sotheby’s Melbourne sale was the smallest of the spring season (grossing just over $2M); the quality of artworks under the hammer gave them an advantage with one of the most solid sale rates at 82.8% by value.

Geoffrey Smith, Chairman of Sotheby’s Australia, said, ‘Sotheby’s Australia has again achieved strong results, reflecting our commitment to presenting well-curated and researched sales from the colonial to contemporary period.’

Flicking through auction catalogues, one often has a sense of familiarity, as certain artists are traded with verve. The list of the most traded artists in 2013 is not all that surprising. Art Sales Digest reports:

Most Traded Artists by Value in 2013:

1. Fred Williams with $7.70M across 26 lots.

2. Brett Whiteley with $6.82 across 61 lots.

3. John Brack with $6.81 across 20 lots.

4. Arthur Boyd with $4.30 across 84 lots.

5. Sidney Nolan with $4.15 across 152 lots.

One day it would be nice to have a living artist on this list! Perhaps then, Resale Royalties might actually advantage an artist’s daily practice.

State of the market?

Chris Deutscher summed up the year, ‘There is no doubt that we have a fiercely competitive market from an auction house perspective. Buyer’s remain selective but there are signs of a growing collector audience.

Deutscher added, ‘We have remained sensible with pricing, and are always on the lookout for truly interesting material. The staggering Bridget Riley result did demonstrate our ability to market internationally from Australia.’

Veteran journalist of the salerooms, Terry Ingram reported this week that ‘Bonhams Australia is closing its decorative arts department following a stall in the market place which has lasted for more than its four years of direct operation in Australia and shows little sign of reversing.’

He added the global group is rigorously positioning itself to take on the two major houses offshore, Sothebys and Christies.

And wrapping up on the global nature of the auction world today, 2013 saw a growing increase in live bidding via the internet. Object based auctions tend to favour this style of bidding more than the fine art auctions, but it is a trend to watch with growing interest with the 2014 sales.

All prices quoted include Buyers Premium.